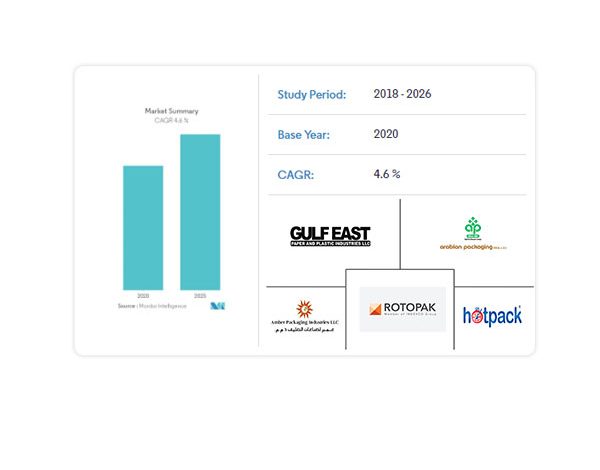

Mordor Intelligence recently introduced a report on UAE Packaging market. According to the report the UAE packaging market was valued at USD 2813.5 million in 2020 and is expected to reach USD 6193.16 million at a CAGR of 4.6% during the forecast period of 2021 – 2026. With rapidly increasing disposable incomes, the spending of the UAE population on different goods is also growing.

- According to the World Bank, the share of the urban population in the United Arab Emirates increased from 84.42% in 2011 to 86.80% in 2019. The number of ex-pats in the United Arab Emirates is also growing, which is expected to positively impact the packaging market growth in various sectors.

- The UAE is one of the largest personal care markets in the Middle East due to its large population. It is becoming the local hub for the beauty and skincare industry. Moreover, the rise of beauty trends is heightened by social media exposure that encourages word of mouth and works as a useful marketing tool. According to Messe Frankfurt, in 2020, the sales value for the UAE’s beauty industry is expected to be worth USD 2.7 billion.

- Thus, the personal care companies are investing in their packaging, vastly the packaging of their products, which always acts as a primary factor to gain attention. For instance, in September 2019, the luxury e-commerce brand Ounass launched eco-friendly boxes to demonstrate its initiatives towards sustainability. Such initiatives highlight the inherent rise in demand for the market studied.

- Moreover, multiple factors are influencing the trend of fast-food culture, which, in turn, is driving the market for food packaging. For instance, better cold chain infrastructure boosts consumer preference for frozen processed halal meat and poultry, cold drinks, and flavored milk across the country, which is tipped to drive industry growth to 2030.

- The Organic Trade Association estimates for 2020, that the forecasted value of organic packaged food and beverage consumption in the United Arab Emirates was over USD 51.2 million as against USD 27.3 million in 2014. As the packaging protects the contents from being crushed or squeezed or contaminated, the market being studied is presumed to grow due to increased packaged food and beverage consumption.

- Moreover, the standardization of the ‘Made in UAE’ initiative, which introduces the local manufacturers to the global market, is helping the country to reduce its reliance on imports and to strengthen its export potential. The positive growth of this kind in the manufacturing sector has encouraged considerable investments in the packaging industry. Most of the investments in the packaging sector are made toward adjusting their packaging practices to the country’s current economic situation and evolving standards.

- However, the region’s unstable economy and decreasing oil prices may hinder the growth of the market. Further, due to COVID-19, Emiratis are cutting back on their spending in all categories, except household essentials. This is expected to increase the use of plastic packaging, especially in UAE food industry. The United Arab Emirates is also dependent on the import of raw materials for corrugated board from countries such as India, where the pandemic caused the closure of paper mills due to lockdown and social distancing norms, leading to a shortage of raw materials.

Scope of the Report

Packaging refers to the process of designing, evaluating, and producing packages. Packaging can be described as a coordinated system of preparing goods for transport, warehousing, logistics, sale, and end use. In many countries, it is fully integrated into government, business, institutional, industrial, and personal use.

Key Market Trends

Corrugated Boards to Execute a Significant Growth Rate Over the Forecast Period

- The reason for the accelerated growth of the corrugated packaging market in the United Arab Emirates is due to an increase in environmental awareness among populations, demand for sustainable packaging solutions, demand for convenient packaging (offset by new restrictions on single-use in some countries), growing e-commerce market, and rise in need for electronic goods and home and personal care products, along with economic development and increasing per capita income. In the December 2018 Paper Arabia trade show, 25% of visitors were interested in the corrugated packaging segment, which was the highest among all the segments.

- Furthermore, the rising penetration of the e-commerce sector in the country is paving the way for corrugated packaging. According to Visa, e-commerce transactions in the United Arab Emirates accounted for USD 16 billion in 2019. Also, the United Arab Emirates represents the biggest annual spending per online shopper at USD 1,648 in the MENA region.

- The use of mini-flute corrugated boxes in some end-user segment enabled corrugated boxes to expand their presence, such as cereal boxes and carryout food packaging. An additional factor that allows corrugated boxes to gain share from paperboard cartons is the introduction of e-commerce-ready packaging that substitutes lightweight and easy-to-open cartons for boxes that can withstand the rigors of shipping.

- Moreover, the United Arab Emirates is also a net exporter of paper and paperboard, majorly to the countries in South Africa and other GCC countries. The paperboard packaging solutions include cartons, leaflets, tubes, corrugated cases, and rigid boxes. Paperboards that are used for fiberboard boxes are the primary means of secondary packaging in most of the end-user industries.

Food and Beverages Sector to Account for a Significant Demand

- According to Dubai Exports, the United Arab Emirates accounts for a large number of food and beverage manufacturing units, totaling around 575 units with a total investment of AED 39.5 billion. Products, such as vegetable oil, canned beans, carbonated and non-carbonated beverages, chicken franks, and reconstituted juices, are generally exported in rigid containers, which are in high demand from the country’s food processing sector

- In most cases, these products are targeted for exports to the EU market. Hence, to meet stringent packaging regulations imposed by the EU, the local food processors and contract packaging companies have a high preference for rigid packaging solutions for such exports.

- Additionally, some locally produced foods are of very high quality at competitive prices. Over the forecast period, as the number of food processing companies is expected to increase, locally produced products are likely to compete with imports of consumer-ready foods, creating considerable demand for price in competitive packaging from the local food manufacturers.

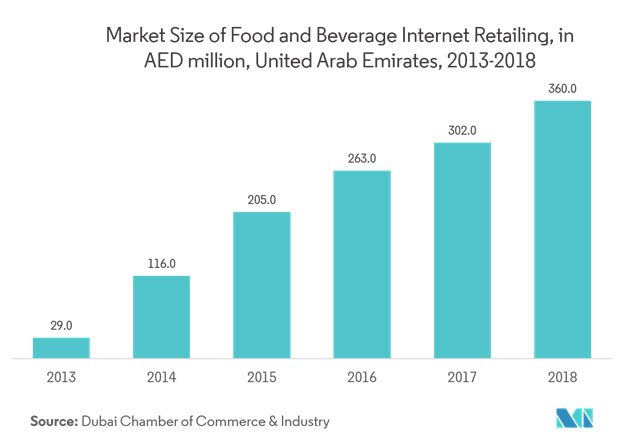

- Further, the growing internet retailing and omnichannel vendors in the region are further expected to boost the production of food and beverage in the country. According to the recent statistics from the Dubai Chamber of Commerce and Industry, internet retailing in the country is growing rapidly. In 2018, the sector witnessed growth by 19%, reaching AED 360 million, representing a CAGR of 65% from 2013 to 2018.

- The increasing demand from packaged food in the country is augmenting the demand for corrugated board packaging in the studied segment. According to Agriculture and Agri-Food Canada, the retail sales value of fortified and functional packaged food in the United Arab Emirates is expected to account for USD 443.5 million in 2020, from USD 199.4 million in 2011.

- Moreover, the e-commerce sector also enables cross-border retailing of products that are expected to improve the demand for secondary packaging from the food and beverage industry over the forecast period.

Competitive Landscape

The UAE packaging market has a wide portfolio of suppliers from the local and international market. This factor leads to high competition among the vendors. In many cases, due to the absence of multiple distribution channels, the vendors directly interact with the end-users to sell their products. This scenario leads to long-term deals with end-users. Hence, the vendors often choose to retain their clients or make new clients by competitive pricing strategies. Additionally, as most of the packaging material is sourced from imports, there is a high competition among the suppliers to capture a limited number of players in the market. This factor is intensifying the competitive rivalry among the local and foreign manufacturers.

Some of the key players in the market include Gulfeast Paper & Plastic Industries LLC, Arabian Packaging Co. LLC, Amber Packaging Industries LLC, among others. Some of the key recent developments in the market include:

- Jul 2020 – Huhtamaki launched a range of high-quality affordable and reusable face masks today. The Huhta Masks are suitable for everyday use and help reduce the spread of droplets into the environment. The comfortable masks are designed to be breathable and washable, and are made of high-quality fabric with anti-microbial and fluid repellent properties.

- Aug 2020 -INDEVCO Paper Containers Launched a New Social Distancing Product Line of corrugated separators to support implementation of social distance measures and maintain safety during COVID19. Responding to the social distancing guidelines imposed for COVID19, INDEVCO Paper Containers launched 100% recyclable, easily locked, and fast-forming corrugated separators used to maintain the appropriate distance, prevent close contact, and secure people’s health and safety in closed areas. This product line provides a lightweight, recyclable, safe and hygienic solution for COVID19 for the workplace, stores, and schools, with studies showing that the virus degrades rapidly on porous surfaces such as cardboard compared to other materials.

For more information and to download the report go to: https://www.mordorintelligence.com/industry-reports/uae-packaging-market.

63 Comments