Taking Packaging To New Heights

This article on package printing was written by Des King as a prelude to drupa 2012. It’s packed with some interesting insights on the digital side of packaging and the latest trends visible in this sector. Read on to know more about package printing and how it increases the on-shelf appeal of products.

With an estimated 75% of all retail products purchased on impulse and over 40,000 different lines in a supermarket outlet to choose from, packaging print will be the crucial differentiator on-shelf, reports Des King.

Research into consumer behavioural patterns in-store indicates that on average three out of every four items that end up in the shopping basket are impulse purchases that are made in about five seconds. Brand loyalty it seems can never be taken for granted. Whilst a number of factors including price offers and shelf placement may determine choice, there’s no disputing over the pulling power of text and graphics in capturing hearts and minds; nor their capability to fulfil a variety of different functions.

Research into consumer behavioural patterns in-store indicates that on average three out of every four items that end up in the shopping basket are impulse purchases that are made in about five seconds. Brand loyalty it seems can never be taken for granted. Whilst a number of factors including price offers and shelf placement may determine choice, there’s no disputing over the pulling power of text and graphics in capturing hearts and minds; nor their capability to fulfil a variety of different functions.

Unlike the commercial sector where it competes against any number of communications options, print for packaging is frontline marketing and fully tuned into the shopping channel. As the direct interface between brand owner and consumer, it is variously required to seduce; to inform; to convince and to reassure at different stages en route from the supermarket shelf and into the home. In production terms it is expected to consistently achieve the highest quality standards at the lowest possible cost.

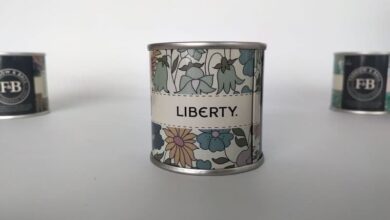

Packaging is habitually subject to any number of seismic shifts in perception, not least as an eco-problem despite its proactive role in pre-empting rather than merely creating waste post-use. In its decorated form, however, its functionality in enabling brands to effectively turn around on a sixpence – and in relative terms cost not much more than that either – has propelled it up the marketing agenda.

Packaging Printing is now directly instrumental in repositioning it from being an engineering activity into a marketing strategy; a transformation wholly initiated by digital technology, and which irrespective of print process continues to dictate the pace of change.

Setting the tone

One of the challenges raised by brand globalisation is how best to resolve the complexities entailed in maintaining colour consistency across not only a widely spread geographical market, but also on different substrates being printed via different processes.

It’s created a knowledge gap that technology developers such as Kodak are seeking to plug, says global packaging segment manager Stu Brownell. “Our vision is to provide sustainable brand management and prepress solutions across the packaging value chain that enable brand security and high impact graphic packaging and in the process raise awareness still further amongst brands as to what print is capable of achieving.”

It’s created a knowledge gap that technology developers such as Kodak are seeking to plug, says global packaging segment manager Stu Brownell. “Our vision is to provide sustainable brand management and prepress solutions across the packaging value chain that enable brand security and high impact graphic packaging and in the process raise awareness still further amongst brands as to what print is capable of achieving.”

Whilst implementing that vision is invariably undertaken by specialist repro houses – now enjoying a new lease of life in operating effectively as brand guardians – brands themselves are taking a closer interest and more direct responsibility, says X-Rite Vice President Sales EMEA & Global Digital Supply Chain- Francesco Tomasello.

“By evaluating their workflow and developing a customised and clearly defined set of standards, we’re helping to free up brands to work with repro bureau’s and PSPs as necessary, and with the confidence that specifications and colour communications will be accurately met independent of market location. In many cases our direct involvement at brand level via the X-Rite’s Global Digital Supply Chain programme leads to a closer working relationship between them and their suppliers specifically within the repro house.”

Converters too are becoming increasingly aware that digitally controlled colour management is part and parcel of an integrated set of workflow solutions designed to strip time and cost out of the prepress process.

“One of the aspects of process automation is that the integration between a company’s business systems and the prepress workflow software eliminates unnecessary duplication of tasks,” notes Jan De Roeck, EskoArtwork Director Solutions Management. “If data has already been entered in the MIS system why should a prepress operator have to input it once more?”

“Think of the consequences of such integration in the context of digital printing. Digital print is synonymous with shorter run-lengths, so to fill capacity, the PSP will have to push through a lot more jobs. That’ll include prepress too, and if you don’t automate as far as you can, if you don’t interface with MIS, you’ll be stuck with a lot of job management prepress overhead. It’ll become a bottle-neck then.”

In addition to a continuing interest in an ongoing development of process and workflow automation, De Roeck also identifies greater adoption of 3D software solutions. “It’s a communication tool and increasingly a Q&A tool in the prepress process as well. The obvious difference between packaging and commercial print is structure; we need to be thinking in three dimensions even from the initial design stage, because that’s what the end product is going to be.”

Pressing engagement

An overarching issue in all packaging print is how best to take cost out of the supply chain wherever possible; in production terms notably via faster makeready and turnaround between jobs. These are the challenges thrown down by cost-efficient digital print and which conventional process is increasingly managing to address; and as a direct result, redefining volume from extended run length to differentiated throughput per shift.

A typical example of modern flexo presses is Mark Andy’s servo-driven 430mm width series, with a running speed of 230m / min and claimed to be profitable for jobs down to 800 linear feet. Setting up the print station takes 35 seconds, with press operators regularly able to upload four separate jobs in less than six minutes.

A typical example of modern flexo presses is Mark Andy’s servo-driven 430mm width series, with a running speed of 230m / min and claimed to be profitable for jobs down to 800 linear feet. Setting up the print station takes 35 seconds, with press operators regularly able to upload four separate jobs in less than six minutes.

Even its staunchest supporters would accede that flexo is not necessarily the most forgiving of processes – an issue that the likes of Agfa, Kodak, Fuji and DuPont are positively overcoming via new high definition digital plate technologies, whose higher dpi and increased stability and consistency on press, deliver a quality result comparable with both gravure and offset.

Meanwhile, offset is also geared up to respond to JIT requirements, with makeready on KBA’s Rapida, for example, completed in less than 10 minutes. Versioning is also well within its remit as a single-colour plate can be changed on the fly simply by slowing the press down to around 12000 off / hr (a 25% reduction), and the imminent prospect of extending that facility to 4 or 5 plates fully in register.

Time to market

The edge of digital lies in the speed within which a job can be delivered to the press – ready to print; and that too immediately on receipt of post-proof approval. Conversely, a flexo plate could take ninety minutes at best to prepare – by which time a digitally printed short-run finished inline will be awaiting despatch to the customer.

HP Indigo now has over 1400 systems installed throughout the global labels & packaging sector; a 76% share of the digital labelling market. By comparison with a 13” narrow-web flexo press, it claims that its Indigo WS6000 press – with a multi-substrate capability of up to 450 micron thickness and a running speed of 30m / min will deliver a four-colour label run in 40% of the time at half the cost of production and generate almost three times the margin.

It’s the sort of guaranteed rate of response that most comfortably fits a retail supply chain model that can demand receipt of goods within 24 hours of order as the norm. It’s also the technology du jour; setting the day to day tempo across all aspects of contemporary culture.

“We have a total belief that just like in the labels sector where digital is becoming mainstream (now accounting for 10% of all labels printed globally), the same thing will happen over time in flexible packaging and folding cartons once the end to end solution is in place. These are relatively early days so we don’t yet have the ultimate solution – but we will build it together with our customers,” says HP Indigo VP and General Manager- Alon Bar-Shany. “Ultimately what we’re trying to do is to enable the brands to differentiate and to innovate. Our aim is that if they can think it, then they can print it.”

Whereas toner based presses from Xeikon and Xerox have hitherto competed on packaging applications with HP Indigo’s proprietary digital ink solution, the steady emergence of faster running inkjet systems – with the added advantage of being suitable for inline integration – is certain to build digital’s overall market share and accelerate the overall rate of adoption.

Also extending more into the packaging sector is digital offset technology from a growing number of press manufacturers’ that include Presstek and Konica Minolta.

Foiling the frauds

The global traffic in counterfeit medicines, as estimated by the Organisation for Economic Co-operation and Development (OECD), is estimated to cost pharmaceuticals manufacturers around 231.7 billion $ (€184bn) per annum. As well as leeching revenue out of the industry – and the profitability to fund further research – it also costs lives; possibly as many as 100,000 each year according to the World Health Organisation (WHO)

Regulatory guidelines such as the recently introduced EU’s falsified medicines 2001/83/EC directive have identified the authentication of the outer packaging of prescription drugs as the industry’s primary and most practical line of defence.

Amongst a number of systems now coming onto the market is coding & marking specialist Atlantic Zeiser’s recently introduced ‘track & trace’ module. Cost-effectively integrated within an existing production line, the module can apply a range of security solutions including GS1 (Global Standards 1); all types of numeric codes, and 1D multi-position barcodes or 2D barcodes (pixel images) to check the legitimacy of the packaging and product online. An optical checking system rejects the pack if the check code doesn’t match the reference data.

Amongst a number of systems now coming onto the market is coding & marking specialist Atlantic Zeiser’s recently introduced ‘track & trace’ module. Cost-effectively integrated within an existing production line, the module can apply a range of security solutions including GS1 (Global Standards 1); all types of numeric codes, and 1D multi-position barcodes or 2D barcodes (pixel images) to check the legitimacy of the packaging and product online. An optical checking system rejects the pack if the check code doesn’t match the reference data.

Ralf Hipp, Vice President, Digital Printing and Coding Solutions Atlantic Zeiser adds, “Latest developments even make it possible to use the packaging material itself as a test criterion such as DNA testing whereby scanning the surface roughness of material can unequivocally identify whether the packaging is produced by the brand manufacturer or not. These solutions allow users to maximise counterfeit security and to minimise losses arising from product piracy. Not only counterfeiting by third parties, but also the grey market problem, can be kept under control through seamless product tracking and sustained anti-counterfeiting.”

Although cost will fall proportionate to volume, current indications are that RFID track & trace solutions will continue to lend themselves more readily to transit rather than retail packaging. In the meantime, whilst advanced coding solutions such as the 2-D datamatrix barcode may be doing much to help manufacturers towards more successfully combating counterfeiting; they can fall short in providing consumers with a similar degree of reassurance.

Seeking change is the new anti-counterfeiting technology from Heidelberg (1-TAG), which incorporates both a 2D data matrix code and an authentication feature based on a unique pattern of randomly positioned copper filaments. Labels can be easily authenticated by any consumer using a smart phone at the point of purchase.

It’s an ideal solution for adoption by the pharmaceuticals industry, says Heidelberg Head of Product Marketing- Jürgen Grimm. ‘To stop counterfeiting, we need to put the best technology into the hands of the people who care the most: the consumers. Western pharmaceuticals manufacturers are in denial on this issue to a certain extent as they would prefer to believe that counterfeiting is mostly confined to cheap medication bought online. In reality it’s one of the highest margin businesses in the world.”

Focus on food safety

Establishing higher standards of security is equally applicable within the food industry, where real or perceived health scares attributable to packaging materials can lead to pricy product recalls and format switch.

The increasing availability of low-migration inks from all of the major suppliers has gone some way towards protecting the converter from the disruption of such an eventuality. A general reluctance to share formulation knowledge, however, can create something of a disconnect, with printers required to guarantee that there’s no migration happening yet as often as not being given no full confirmation of what they’re actually putting on the sheet.

Although not toxin-free and therefore automatically precluded from food packaging in some countries, UV printed packaging represents the optimum balance between practicality and safety provided that it is 100% cured. Water or solvent based inks can take several hours to dry, whereas UV coatings that lie on top of the substrate are cured more or less as soon as they’re exposed to the UV light; in consequence, making UV curing systems an integral feature of most offset press configurations.

Next-stage development could be the wider adoption of lower energy consumption but significantly more expensive LED – well-established in the digital inkjet wide format sector – as a replacement for the UV curing arc lamp de facto industry standard.

About Des King

Des King is a freelance journalist, whose main interest lies within the packaging sector and the increasing impact of digital technology. His articles talk about the role of packaging within product branding strategies, and ways in which packaging can be made more user-friendly to fellow grey consumers. Prior to being a journalist, he was the Marketing Director at Reed Exhibitions (UK) for seventeen years, where he was responsible for the promotion of PAKEX (packaging), INTERPAS (plastics) and IPEX (printing) events.