World market for digital packaging to grow by CAGR of 13.6% to 2020

The Future of Digital Print for Packaging to 2020, a market report by Smithers Pira, values packaging printing with toner and inkjet at $10.5 billion (€9.4 billion) for 2015. This covered the printing of the equivalent of some 107 billion A4 prints.

For the remainder of the decade, the world market value will grow by an average of 13.6% year on year, with annual print volume increasing at a rate of 16.2%. Growth in the Middle East will be particularly strong, annual expansion significantly above 20% for both volume and value.

Globally labels account for 80.5% of total value and 93.5% of the print volume in 2015. This predominance is changing as new applications are introduced. Growth in non-label print segments will significantly exceed that for labels across 2015-2020. Digital packaging is growing strongly because it is cost effective for short runs and offers brands and retailers new functionality.

Electrophotography is liquid or powder toner ‘laser’ printing, a contact process that transfers colorant via a charge photoconductor surface. It can be very high quality and is widely used in label production on some cut-sheet, but mainly narrow web formats. The alternative – inkjet – is non-contact, using liquid inks ejected from precision heads onto the substrate and there are various drying mechanisms.

Electrophotography is a process leading the way within the market place but inkjet is forecast to grow faster and overtake the volume of electrophotography in 2018. The non-impact inkjet processes are more suited to printing larger formats on a wide range of substrates making it more suited to packaging, and it can be integrated into existing conversion lines more easily. The ink developers are now formulating inks suitable for printing onto many substrates at high quality with food safety compliance high on the list of priorities.

Digital print for packaging is one of the few rapidly growing segments of print. Packaging is commonly divided into six categories with different degrees and prospects for digital penetration. While labels are still the majority of the sector all other segments are growing, with corrugated, cartons and flexibles becoming significant markets before 2020 – the prospects for growth are weaker in rigid plastic and metal formats.

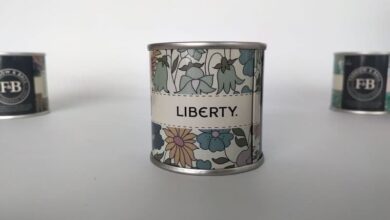

Labels was the first sector to use digital printing, because most self-adhesive labels are printed narrow web on lightweight substrates well suited to the process. Equipment suppliers, notably HP Indigo and Xeikon, recognised this opportunity early and introduced technology well-suited to label production. Digital packaging demand will continue to grow, into more segments – offering many advantages to packaging converters, buyers and retailers – and most importantly satisfying evolving consumer demand. New functions enabled by digital print that are valued and useful – such as increasing emotional engagement – are being enabled, as manufacturers launch new equipment and inks/toners.

The economics and productivity of digital technology is continuing to improve, making it increasingly competitive against analogue printing processes for more than just short runs. Eliminating plates, much prepress and simplifying press make-ready means digital methods are much lower cost to set up than analogue alternatives. While the unit cost of print is then higher, digital will be lower cost for short runs which remains the prime driver for adoption.

Simultaneously digital can add a great deal of value and open new applications. Digital technology can print totally variable data and this can help to increase the bond with consumers and potential customers by tailoring the content for individuals or groups. This can boost the brand status as has been demonstrated with Coca-Cola’s “Share-a-Coke” campaigns.

This has proved to be a significant watershed, bringing the capabilities of digital to the attention of brands, converters and designers in how they can leverage packaging as a new tool to engage with customers.

A further impetus driving digital’s market penetration in packaging is coming from equipment and toner manufacturers. Many companies are now developing new equipment as they strive to get a share of a growing print market with high-profile examples under development and other systems away from the public eye. Digital packaging technology is developing to boost productivity against analogue incumbents. And the capabilities of personalisation and versioning to maximise consumer and provide security features are emphasised in their marketing materials.

By 2020 there will be much greater choice for converters, to buy turnkey machines or to integrate components into conversion lines. The rate of development for inkjet will be more rapid than for electrophotography for packaging applications, with more players across the supply chain improving their part of the system. The non-impact nature of inkjet makes it easier to integrate into established packaging lines to provide variability electrophotography.

The key message is that digital print equipment and consumable suppliers are in no particular hurry to match analogue print systems. They should not. Flexo, gravure and offset litho are successful and have passed the test of time. Digital methods will do more, providing variability, personalisation, print-on-demand functions that analogue cannot accomplish. As the productivity and formats increase the cost position will strengthen and digital will be suitable for more of the work.

We are offering ME Printer readers an exclusive discount of 10% on this report until 30 June 2016 2016.

Please visit Smithers Pira

[http://www.smitherspira.com/industry-market-reports/printing/digital/the-future-of-digital-print-for-packaging-to-2020]

quoting discount code: ME10OFF

Smithers Pira is the worldwide authority on packaging, paper and print industry supply chains. Established in 1930, Smithers Pira provides strategic and technical consulting, testing, intelligence and events to help clients gain market insights, identify opportunities, evaluate product performance and manage compliance.