Labelexpo India 2022 Roadshow Held at Ludhiana

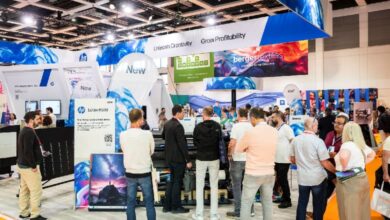

Due to digitization the demand of commercial printing is decreasing, taking this fact in view, a technical roadshow is organized at Hotel Park Plaza on 14 October 2022 in collaboration with the Offset Printers Association. The event, organized to spread awareness among the regional print businesses about the latest and upcoming technologies and machinery being displayed during the Labelexpo India 2022, witnessed the attendance of more than eighty renowned printers of the city. Labelexpo is going to take place at Greater Noida on 10-13 November 2022.

Speakers from Avery Dennison, Flexo Image Graphics, HP Indigo and Fujifilm Sericol gave presentations on the current label industry trends and to understand about business diversification opportunities available to coverup the decreasing print business.

Speaking on the occasion, Prof. Kamal Mohan Chopra, President, World Print & Communication Forum (WPCF), said, “Print businesses today need to diversify in new segments to ensure business profitability. Labels and packaging are among the fastest growing segments in the print industry and is a fantastic opportunity for commercial printers to diversify for growth. I highly encourage everyone to attend Labelexpo India 2022 in Greater Noida and learn about modern technologies in labels and package printing.”

Earlier, welcoming the audience Mr. Parveen Aggarwal, President Offset Printers Association (OPA) highlighted the current business scenario and invited the members for adopting latest technologies to be competitive in the global print market. He said that commercial printers across country are looking to diversify in labels and packaging industry for business expansion.

Pradeep Saroha, Event Director of Labelexpo India, said, “We are grateful for Offset Printer Association’s support for Labelexpo India which goes back 12 years. I thank the association for making the roadshow a success. We invite all the OPA members to attend Labelexpo India 2022 and take advantage of the unmissable opportunity for the industry to come together under one roof and reunite with industry peers to witness and be a part of the future of print technology.”