InPrint 2016 survey indicates accelerated growth for industrial printing

InPrint Show, the exhibition for industrial print technology, in partnership with IT Strategies, has launched an industry survey completed by 150 respondents from across the globe to highlight key trends and insight for the continued development of industrial print production.

The objective of the survey was to gain insight and understanding of the pace of development within the marketplace, in addition to unearthing the key issues and discovering what kind of future industrial print technology can look forward to. The survey and report features analysis on growth opportunities for new markets and tackles the challenges confronting a sector under intense pressure for high quality production in challenging and changing manufacturing conditions.

Marcus Timson, InPrint Show co-founder comments: “The survey results and report analyses the challenges, trends and highlights the opportunities for industrial print technology. The results reveal a sector rich in innovation and one that is developing at a fast pace. However respondents also felt that there were some key challenges and initiatives required in order for industrial print to continue to develop including improved collaboration and improved knowledge of industrial inkjet. In addition, a core challenge for the industry is in making the right investment decision for the next stage of industrial inkjet development and InPrint has a clear role to play in this regard as the show continues to inspire the sector to grow and develop.”

Growth predictions

Industrial print continues to be the rising star of the printing technology sector. The adoption of new technology has been consistent over the past 18-24 months. The unique capabilities of industrial printing as both a functional and decorative process means it performs a critical role in the production of multiple products and processes empowering the manufacturing industry to adapt to constantly changing consumer demand.

Given the strong indicators towards growth for industrial printing, it is therefore unsurprising that the overwhelming majority of respondents believe growth is 5% or above. This suggests that the technology sector is developing quickly. Nearly 34% believe this to be double digit growth which is an increase of nearly 10% on 2014 where 25% of respondents believed growth to be 10% or above. This is due to the continued evolution of industrial inkjet capability and rapid change in manufacturing production. This is also believed to be in line with consumer change and the need for flexible, just in time manufacturing which is transforming a number of industries. Less than 2% believe there to be no growth.

New applications

There are a number of key benefits that the investor is looking for when acquiring new industrial print technology. However the benefits one would consider to be perhaps the strong USP’s of digital production are not necessarily the main drivers. For example, the potential for automated production with (29%) came out as the least important. However what is regarded as the lead benefit, by some distance, is the ability to print onto new applications (75%). This is perhaps due to a desire to add value, diversify or indeed open up entirely new markets.

The second is flexible production, which is a key digital benefit with (51%) and lower production costs with (46%) rounding off the top 3. For industrial screen printing this suggests it has retained a high value due to its continued importance in the manufacturing process of many products. For industrial digital and inkjet printing it is an indication of the fact that new value is being created and that this is highly valued. Therefore lower production cost is not the main driver.

Open collaboration

By some margin (72.48%), respondents believe that more open collaboration between suppliers is required in order for the market to continue to develop effectively. This is closely followed by the need for greater knowledge from the entire supply chain. Collaboration is really essential for industrial print. No one vendor has all of the answers and a number of different providers must collaborate in order successful development to be achieved. It is clear industrial printing could benefit from more open collaborative development in order to increase effective integration into manufacturing. A high level of secrecy coupled with an unwillingness to work together could slow development.

Packaging and textile

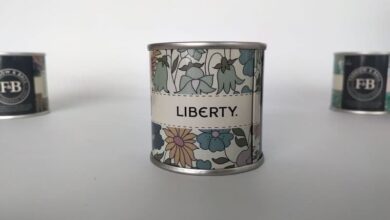

Packaging (60%) is perceived to lead as it continues to enjoy a period of investment by suppliers to the industry particularly in relation to industrial printing. Consumer brands continue to place importance upon its position within the marketing of products and print is clearly a key technique for distinguishing and enhancing a product from a sales perspective. As well as product decoration and the growth of direct to shape printing, which is attracting plenty of attention, it should also be noted that coding and marking and security printing is also growing in its importance.

FMCG brands are keen to protect their products from a trade mark perspective but also to be able to effectively track and trace for security purposes. Digital inkjet printing affords retailers and brands the ability to manage stock levels and distribution, controlling cost, optimising sales and minimising waste.

Perhaps as exciting as textiles is the high level of respondents who believe that interior decor onto new surfaces with (47.79%) are set to make considerable gains. This is supported by the growth in decor printing particularly evident at InPrint. Further down the list, but still credible and noticeable is functional printing (29%). However despite the hype surrounding 3D Printing, this is still languishing far behind all other processes in terms of real life, real time use.

Technological innovation and changing consumer trends

Technological innovation is driving new possibilities of production in a whole host of industries. Print technology seems rather blessed in this regard to have an analogue process such as screen printing that is particularly suited to a wide range of applications including new markets such as smart technology. In addition, inkjet technology is maturing and becoming ripe for use in multiple applications mostly to create new value that compliments rather than displaces analogue printing.

From these results, it is clear that the main drivers of change are two-fold. Technological innovation leads with (69.54%) and is a result of vendors seeking new markets, enabling new potential never previously possible. This isn’t entirely digital’s domain. New market formation in consumer electronics, smart technology and the inevitability that this will grow means that sectors such as automotive are pushing industrial screen printing to meet an innovation need for smarter technology. But in order for any new technology to be adopted, there must also be a pull from the top of the supply chain, the consumer (56.29%). This climate is essential for change. New industrial printing solutions are clearly required in order to meet a more diverse and fragmented set of needs from a continually evolving consumer who has sophisticated knowledge, taste and requirements. And this trend is particularly well suited to digital production. Not far behind (42.38%) these two key trends, a changing manufacturing segment is restructuring in order to meet a need for Industry 4.0 and digitization of manufacture.

Development of inks and materials

In order for industrial inkjet to grow in its use it makes sense that continuing improvement of the core technology is needed. The incredibly demanding nature of industrial printing means that quality and durability must be of the highest standard. From this survey 60.40% believe the main issue is improved choice of inks and materials for industrial inkjet. The development and growth of industrial inkjet is clearly challenging ink and material manufacturers to adapt and innovate to meet new demands. This is not an easy task given the diversity of different applications and industries. This challenge is however being met, but this will remain a leading issue for some time to come. Industrial printing is both engineering and chemistry.

So, advancement in engineering capability will not always coincide with convenient development in chemical manufacturing. Secondly, improved quality (51.01%) is deemed as important which is no surprise given the intolerance for less than perfect production. In third place is faster systems (47.65%) which is an important facet of any industrial process. Whilst these challenges are being met

with the advent of single pass systems and general improved speed and head development, for industrial inkjet to thrive in industrial conditions, the considerable challenge of both producing high quality print at speed must be met in order for increased adoption to occur.