The Digital Transformation Of Industrial Printing

Since ancient times, people around the world have been looking to beautify their environment and enrich their lives using decorations. They have used decorative glyphs, paintings, and written words in monochrome and color to reflect their lifestyles and to communicate functional messages (e.g., a green light means go!). Innovators on worldwide basis always seek solutions for the deposition of decorative and functional materials on everyday objects and surfaces. Some of these designs were intended to convey information, while others created a striking visual effect or enhanced functionality. First came early block printing on paper and textiles, and then the game-changing invention of Gutenberg’s printing press with movable type in 1440.

Since the time that Gutenberg revolutionized printing 575 years ago, this manufacturing process has evolved as a precise deposition of colorants or materials as part of graphic arts applications and industrial applications. Graphic arts technology evolved to produce printed matter used for information sharing, promotional activities, education, and a range of utility documents. Industrial printing became a technology used for enriching the decorative elements in everyday surfaces like packaged goods, decorative surfaces, and sophisticated functional materials for the electronics industry. Industrial printing applications have historically been produced using a variety of analog printing technologies, such as offset, gravure, flexographic, and screen printing. The range of applications is dazzling, spanning applications such as textiles, ceramics, flooring, laminates, glass, wood, membrane switches, printed electronics, packaging, and even some bio-medical materials.

The impact of mass customization

The driving force behind these developments was the need to mass-produce printed items like books or packaged consumer goods from leading industry brands. Items such as fashion fabrics, decorated laminates, ceramic tiles, and product packaging became available to consumers with the help of mass production processes and technologies. Although mass production reduces unit price, it requires a large investment in manufacturing capacity as well as a suitable supply chain to manage the inflow and outflow of materials and goods.

According to InfoTrends’ estimates, worldwide mass-production of decorative products accounted for just under half a trillion dollars in manufactured goods in flat glass, ceramic tiles, flooring/laminates, textile, and wallcoverings.

According to InfoTrends’ estimates, worldwide mass-production of decorative products accounted for just under half a trillion dollars in manufactured goods in flat glass, ceramic tiles, flooring/laminates, textile, and wallcoverings.

Our desire to increasingly customize our surroundings coupled with relentless innovations in materials science and digital material deposition technology is a major driving force in the transition from mass-production to mass-customization. This transition enables consumers as well as institutional buyers to customize their environments with branded imagery, or with decorative surfaces that reflect their tastes and visual sensibilities. Digitally printed output is now increasingly used to enable mass-customization while also providing a range of other benefits, including operational efficiency in manufacturing and a positive environmental impact.

Industrial printing in the digital age

Over a generation ago, digital printing emerged with a range of technologies that ushered in new integrated production processes as well as the ability to customize or personalize products. Although promising, early innovations were often expensive and did not yield acceptable quality for end-users. One of the leading technologies in this space was inkjet printing. For many years, inkjet printing technologies like drop-on-demand and continuous inkjet struggled to gain acceptance due to high costs, reliability issues, and a limited range of available materials (e.g., inks and substrates). These factors hampered the range of applications that could be produced.

Over the past two decades, surging technological developments in materials and printheads have yielded a crop of products that have effectively transformed industry dynamics to enable mass-customization of graphic arts products using inkjet technology. These changes are quickly expanding into industrial manufacturing as well. At their core, these inkjet solutions enable manufacturers to produce quality products while benefiting from the operational advantages of digital print.

As important as operational efficiency may be, it is only one of the ingredients that is driving market growth. The ability to cost-effectively manufacture products in short runs is democratizing the creative process. In a market where printing requires less make-ready and inventories are significantly reduced, brand owners and designers are now free to explore new products, materials, and manufacturing technologies that do not require as high an investment as mass-produced products. Fueled by the Internet, these products generate demand for a range of applications that were previously unavailable to consumers and businesses. Compounded with the operational benefits, these market-driven opportunities can spell profitable growth for companies of all sizes.

As important as operational efficiency may be, it is only one of the ingredients that is driving market growth. The ability to cost-effectively manufacture products in short runs is democratizing the creative process. In a market where printing requires less make-ready and inventories are significantly reduced, brand owners and designers are now free to explore new products, materials, and manufacturing technologies that do not require as high an investment as mass-produced products. Fueled by the Internet, these products generate demand for a range of applications that were previously unavailable to consumers and businesses. Compounded with the operational benefits, these market-driven opportunities can spell profitable growth for companies of all sizes.

The industry landscape

The printing technology spans a broad range of industries including graphic communication, packaging, decorative, and functional printing. A common element to all of these industry segments is the need to precisely deposit a range of materials such as ink binders and functional materials. These are deposited on a variety of surfaces from sheets of paper to 3D printed objects. Core technologies typically migrate to adjacent markets; for example, a technology that was initially adopted by one segment will find its way into a related segment and will later be modified based on the new segment’s specific needs. Although the digital revolution has taken several paths, the most prominent to date has been in the graphic communications market. Digital print-on-demand is now well-established in this area, with over 1 billion A4 impressions produced annually. The use of digital technology is now migrating and growing in industrial segments such as packaging, decorative, and functional printing.

To better understand the key trends that are impacting the various industries, we compiled a short description and some examples to illuminate the solutions that are available in these industry segments.

Packaging

Packaging is a massive industry, and InfoTrends’ industry assessments estimate that it accounted for over $400 billion in related revenues on a global basis in 2014. Applications span from simple marked corrugated brown boxes to award-winning labels for premium products. Over the past few years, digital color technology has established a critical base of electrophotographic and inkjet solutions. These accounted for about 1 billion square meters in 2014 and are projected to reach 2 billion square meters in 2019, representing a compound annual growth rate (CAGR) of 23%.

Thanks to a new generation of inkjet presses, this market is now reaching folding cartons, flexible packaging, direct-to-shape, and corrugated printing. These systems go beyond proofing into fully integrated production lines. Solutions that are targeted toward corrugated liner manufacturing or sheet fed printing of corrugated boxes/displays are now available from key industry suppliers with print speeds exceeding 200 meters per minute.

Thanks to a new generation of inkjet presses, this market is now reaching folding cartons, flexible packaging, direct-to-shape, and corrugated printing. These systems go beyond proofing into fully integrated production lines. Solutions that are targeted toward corrugated liner manufacturing or sheet fed printing of corrugated boxes/displays are now available from key industry suppliers with print speeds exceeding 200 meters per minute.

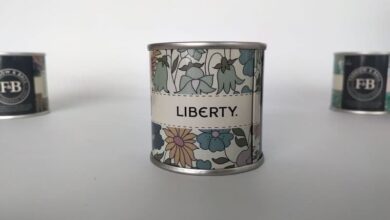

Direct-to-shape is another example of an emerging category where graphic arts, technologies, and industry-specific suppliers have come together to meet the demand for customized printing like never before. Examples include a major brand that is now offering digitally printed beer bottles that are fully customized and linked to an augmented reality campaign. This isn’t a completely new concept, except that it is now being done on an industrial scale by a mainstream manufacturer.

Decorative printing

Decorative printing is a vast market segment with a number of applications that are taking advantage of digital printing capabilities. The digital print volume in this segment is large and growing rapidly. Although many applications exist in this segment, this article will focus on ceramics, textiles, laminates & wood, wallcoverings, and glass, which are leading the digital transition.

Ceramics

The market for ceramic tile is huge, with over 12 billion square meters of tile manufactured worldwide in 2014 based on an InfoTile report. This industry segment traditionally used rotary presses to deposit decorative ceramic inks onto tiles ahead of the firing process, resulting in a cost-effective product that rivalled the permanency of natural stone.

At the same time, however, using rotary print cylinders has its drawbacks—pattern repeats are limited and require costly changeovers. Because digital printing has dramatically improved time-to-market, enabled design changes, and reduced make-ready, it now captures the majority of tile manufacturing in Europe and is gaining a rapidly-growing share in China. Moreover, digital technology offers dimensional printing in later firings to add texture in addition to the decorative layer.

At the same time, however, using rotary print cylinders has its drawbacks—pattern repeats are limited and require costly changeovers. Because digital printing has dramatically improved time-to-market, enabled design changes, and reduced make-ready, it now captures the majority of tile manufacturing in Europe and is gaining a rapidly-growing share in China. Moreover, digital technology offers dimensional printing in later firings to add texture in addition to the decorative layer.

Textiles

Textile printing is a far-reaching industry with a deep-rooted heritage in countries like Italy, Turkey, India, Japan, Korea, and China. Based on InfoTrends’ Digital Textile Forecast, printed fabrics accounted for over 35 billion square meters in 2014—and 800 million of this volume was digital. Although most of these fabrics are produced using silk screens or rotary presses, the use of digital printers is rapidly increasing. This unique industry has been creating dazzling designs since wood-carved blocks were used to stamp fabrics.

Great strides have been made since that time, and the prevailing technology for high-volume fabric manufacturing is now rotary screen printing. Now that specialty inks can be used with a wide range of manmade and natural fibers, it is possible to create cost-effective finished products with bright colors and bold designs.

The ever-increasing need for improved operational efficiency and the desire to provide consumers with cutting-edge designs was a key driver in the market’s evolution. Since the early 1990s, inkjet technology vendors have attempted to make inkjet a suitable solution for fabric manufacturers. The past few years have seen a rapid growth in inkjet printing on fabric for organizations of all sizes. InfoTrends’ Digital Textile Forecast projects that digital textile fabric printing will demonstrate a CAGR of over 30%, surpassing 3.2 billion square meters by 2019. This rapid growth can be attributed to a reduction in make-ready, cost reductions in environmentally friendly production, and the democratization of designs that enable brand owners to reach markets quickly and effectively.

Laminates & wood

Within the construction and furniture industries, woodworking products have been making use of printed decorative papers and laminates for decades. With a wide range of designs that mimic natural wood grains, stone, and graphic patterns, laminates are a cost-effective substitute for natural materials. In some cases, laminates are actually preferred because they are more durable. Typically produced using gravure presses, decorative papers are converted to laminates using a range of processes. This industry produced over 300 million digital square meters in 2014, based on InfoTrends’ document entitled Profiting from Digital Printing in the Décor Marketplace. The pressure to develop short-run or custom laminates is driving an increased demand for mid-range as well as industrial products that rival the printing volumes of traditional gravure presses.

Many leading providers of laminates and décor paper (e.g., Schattdecor, WilsonArt, and Formica) are now offering custom laminates based on end-users’ demands for increased levels of design freedom and customization. These trends follow many years of successful production of laminate flooring as well as a range of decorative trims for the construction industry. Emerging on the heels of laminate solutions is a range of direct printing solutions produced on a variety of wood products such as Medium Fiber Board (MDF), plywood, and natural wood. These do not require lamination and are used for adding a decorative surface to residential and commercial applications.

Wallcoverings

Wallcoverings have been in existence since the ancient Chinese decorated their palace walls. More recently, King Louis XI of France ordered wallpaper for his royal dwellings in 1481. Creator Jean Bourdichon painted 50 rolls of paper with angels on a blue background because King Louis found it necessary to move frequently from castle to castle.

Wallcoverings have made great strides since that time, and they are now readily available to everyday residences and commercial buildings. Technologies such as surface printing, offset, flexography, and gravure printing have been widely used to produce standard wallpapers, with volumes estimated at 52 million square meters annually in 2014 based on InfoTrends’ Profiting from Digital Printing in the Décor Marketplace.

Wallcoverings have made great strides since that time, and they are now readily available to everyday residences and commercial buildings. Technologies such as surface printing, offset, flexography, and gravure printing have been widely used to produce standard wallpapers, with volumes estimated at 52 million square meters annually in 2014 based on InfoTrends’ Profiting from Digital Printing in the Décor Marketplace.

Digital wide format printing solutions ushered in generations of innovative graphic communication solutions for the plethora of industries that have been migrating to the wallcovering segment. Advancements in digital printing inks (e.g., latex and flexible UV inks) now enable printing on standard industry media that complies with health and safety codes. Applications such as murals and graphically rich wallpaper rolls are becoming increasingly common and are now available from a number of suppliers.

Glass

Decorative glass has been adorning cathedrals, palaces, and a range of public and private buildings for millennia. Applications span from leaded stained glass to screen-printed glass panes, and these items have been used to reinforce branding, promote artistic expression, or create simple signage. According to the Global Flat Glass Industry Trend, Forecast, and Opportunity Analysis by Lucintel, the flat glass market is expected to surpass $66 billion by 2019 and is starting to adopt digital printing as a means of expanding its reach. With the development of inkjet printheads that are capable of printing ceramic inks onto glass, a number of industries are using digital printing technology to produce long-life decorated glass that is suitable for architectural and industrial uses.

Functional printing

Another type of industrial printing is where the printed surface is deposited with material or ink to enable some functionality. These applications take advantage of piezoelectric or continuous drop devices to enable deposition of a variety of materials. Applications include membrane switches, printed electronics, 3D printing, and a range of new innovations in small particle sizes (e.g., nano-particulates) that are expanding into pharmaceutical and bio-medical applications. This section will highlight some of the developments that enable membrane switch printing, printed electronics, and 3D printing. While there are a number of other very compelling deposition technologies, these are typically limited to specialty industry forums in the life sciences industry.

Membrane switches

The American Society for Testing and Materials (ASTM) defines a membrane switch as “a momentary switch device in which at least one contact is on, or made of, a flexible substrate.” These flexible substrates are typically printed on PET (Polyethylene terephthalate), which is used as a base carrier. They are very common within home appliances, medical devices, games, smartphones, and toys.

Printing technologies are regularly used in the production of the graphic overlays as well as the some of the circuitry where conductive inks are used. Advancements in digital UV printing technology—including flexible inks and Light Emitting Diode (LED) curing—are expanding the range of membrane switch applications and carrier materials to include flexible substrates that can be cured with less energy and heat. In certain higher-volume applications, curing using EB (Electron Beam) technology enables deposition and curing on sensitive materials. In all of these cases, short-run of customized print can take the place of screen or flexographic printing technology.

3D printing

The 3D printing industry is a vast space with many different technologies, applications, materials, prices, and solutions. Current 3D print technologies include binder jetting, digital light processing, electron beam melting, fused filament fabrication, material jetting, selective deposition lamination, selective laser sintering, and stereolithography. All of these technologies have their pros and cons, and it is likely that this list will grow even longer over time as more vendors make their own contributions to this space.

The market is delineated along three product categories: production, professional, and personal. Typical applications created on 3D printers include prototypes, molds & dyes, and end-use products. These applications are being used by almost all industries to create a variety of products from nano-sized research products to airplane parts. This segment is evolving rapidly, and hardly a day passes when we don’t hear about a new innovation that enables another compelling application. The attraction in 3D printing is its additive nature—waste is limited, time-to-market is shortened, and custom designs are possible.

Printed electronics

One example where digital technology is emerging as an alternative to more complex and costly implementation is the creation of OLED (Organic Light Emitting Diode) display components.

Digital display printing is at the forefront of innovation, but digital deposition of functional materials has been in development since the early 1990s and can now be found in applications including Radio Frequency ID (RFID) tags, smart textiles, and many more printed electronics. At the same time, however, conventional printing technologies such as flexography and photolithography are still in use in high-volume manufacturing of printed electronics. This provides numerous opportunities for growth in this industry for a range of specialty print providers.

Executive summary

Industrial printing has been performed using traditional printing technologies for decades, and the product value far exceeds the direct value of printing as a standalone activity. Although it is estimated that printing may account for about 25% to 30% of value, this share varies widely by market segment. The growth in all segments is driven by consumer consumption and demand for durable and non-durable products from packaging, textiles, and the housing market. The main drivers of growth or decline in these segments are thus highly dependent on the global economy and local consumer spending patterns.

This strong base of productivity and demand and a growing desire for mass-customization creates a fertile ground for innovative digital printing technologies. Inkjet printing is the dominant enabler of this transition. Following several decades of technological developments in jetting and materials science, we are now seeing a resurgence of technologies that enable deposition onto applications including packaging, ceramics, textiles, 3D objects, and electronic components. During the drupa 2016 event in Dusseldorf, Germany, the world will converge to explore and observe new technological innovations in print and material deposition. Many of these will certainly take aim at industrial and functional printing solutions.