The Fifth drupa Global Trends Report Announced

Clear pattern of improvement demonstrable for most but not all markets and regions since 2013

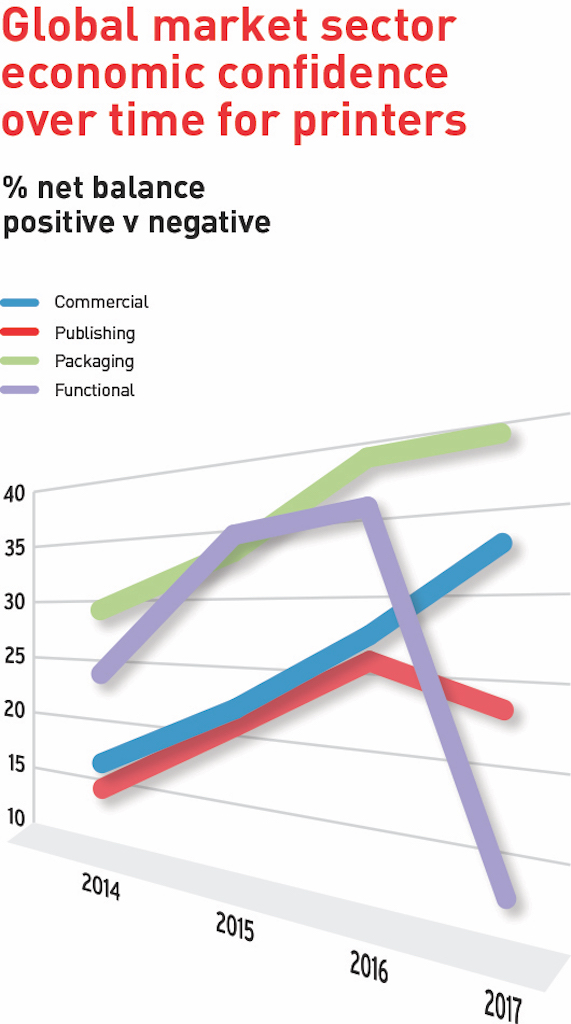

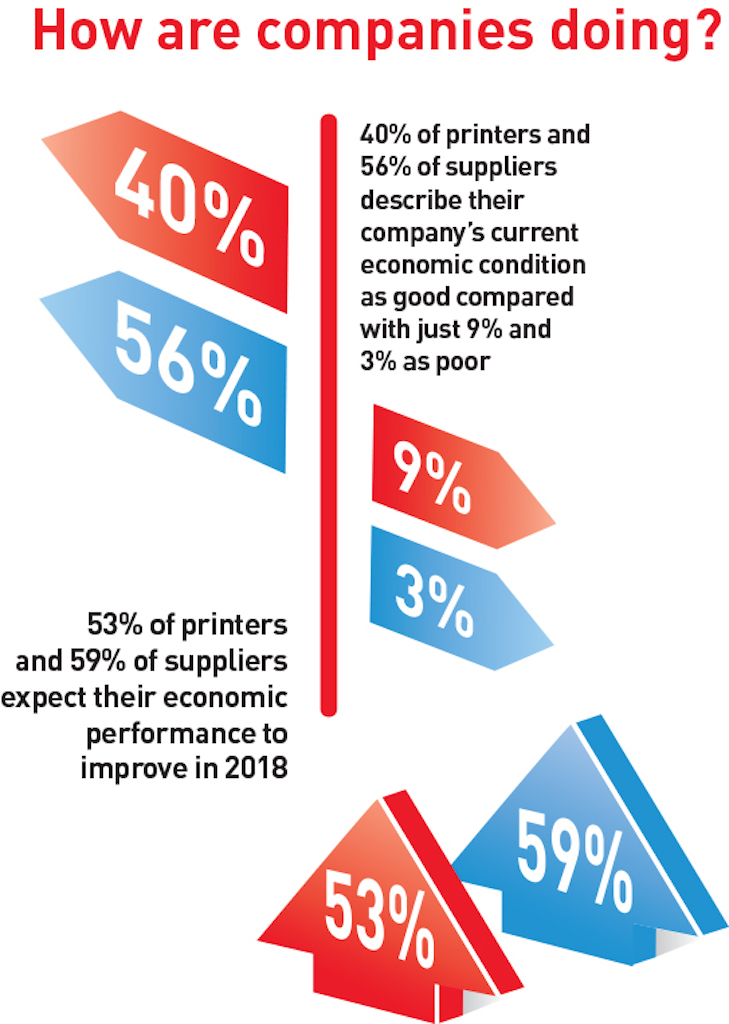

Printers and suppliers from the majority of market sectors reported growing confidence in their companies’ economic performance. The opportunity was taken this year to track patterns of performance over the years. Packaging remains the most buoyant market and there has been a steady improvement in confidence over the five years amongst Commercial printers.

Functional printers were following a similar positive story but there was a puzzling increase in uncertainty this year for both printers and suppliers to this market. Publishing printers probably face the most challenging strategic changes and there is a decline in assurance this year, despite the reducing threat from E-books.

Sabine Geldermann, Director drupa, Messe Duesseldorf, commented, “The report indicates that print can be optimistic about the future. After the double blow of the 2008 global recession and the consumer shift to digital communications, printers and suppliers are taking full advantage of the slow but clear global economic revival and finding new ways to exploit emerging technologies so as to place print as a central tool for consumers.”

Recruited from senior managers who visited drupa in 2016, over 700 printers and almost 250 suppliers participated in the survey run by Printfuture (UK) and Wissler & Partner (CH). Richard Gray, Operations Director at Printfuture, states, “Both printers and suppliers clearly understand the strategic challenges that print faces. However, there is increasing confidence in a strong future for printers in most markets and regions, as long as they analyse their target markets carefully and make suitable innovations to meet the future needs of their clients’ customers.”

Challenges for some regions

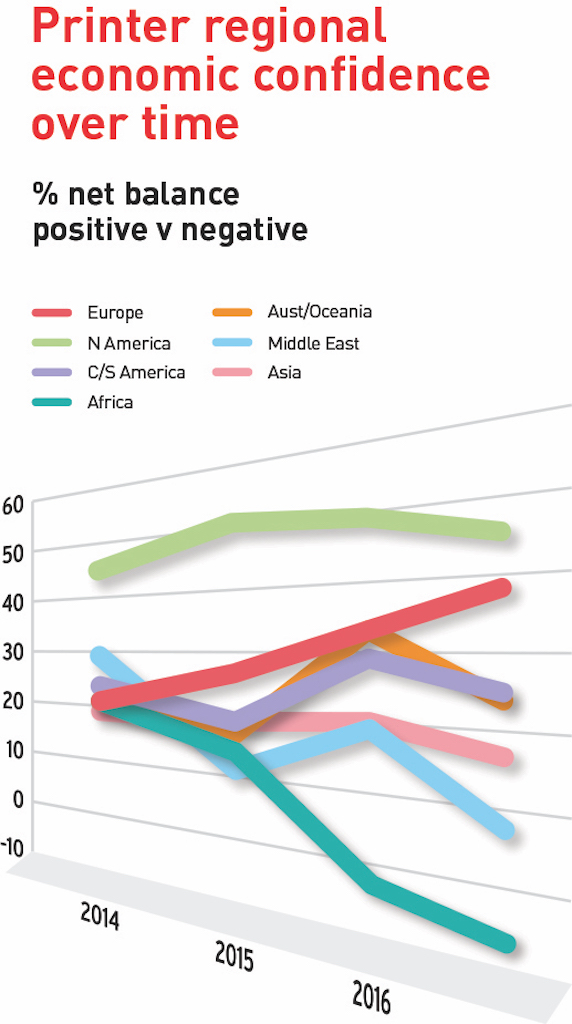

In regional terms again the picture is positive in general but with clear exceptions. North America has been consistently the strongest region over time, although Europe has shown steadily increasing confidence. Sadly Africa and the Middle East see a clear decline in confidence over time.

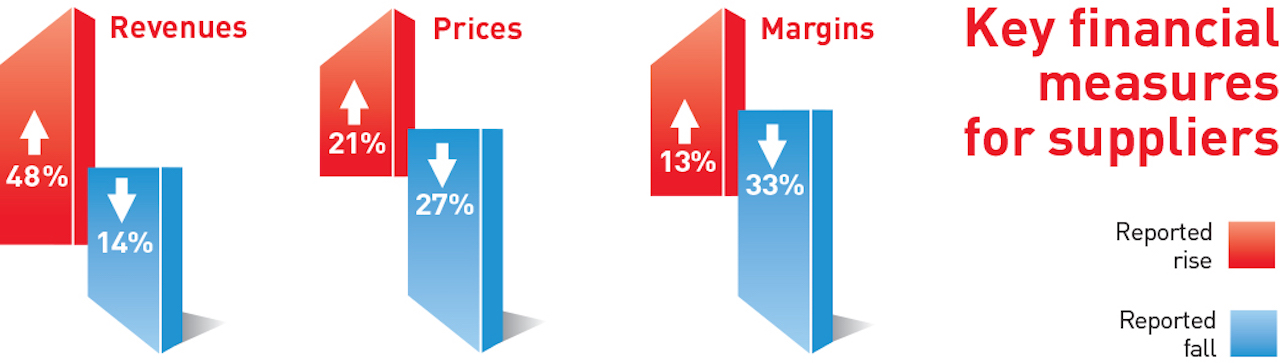

Globally this is the fourth year of increasing confidence reported by suppliers. What is striking this year is the surge in sales of core equipment/software/materials (+29% net balance). Indeed all supplier revenue streams showed their best ever net positive balance.

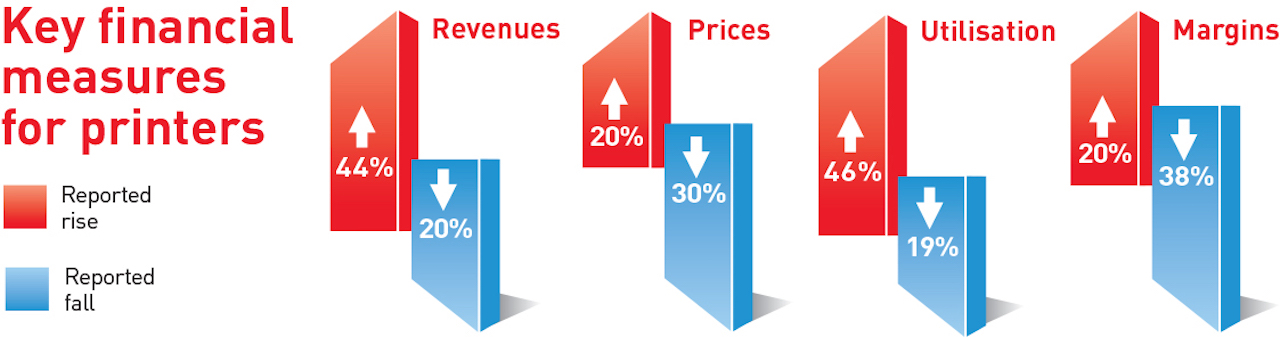

Printers globally report that the squeeze on prices and margins continues and is coped with best by ever-increasing utilization and hence revenues, whilst holding costs as steady as possible. There is evidence that over time the squeeze on prices and margins is somewhat lessening globally. However, the regional picture is far more patchy. For example whilst North America reported some increase in prices, Australia/Oceania reported a clear drop in pricing. Equally Packaging prices are holding up globally whilst Publishing and to a lesser degree, Commercial prices continue to decline.

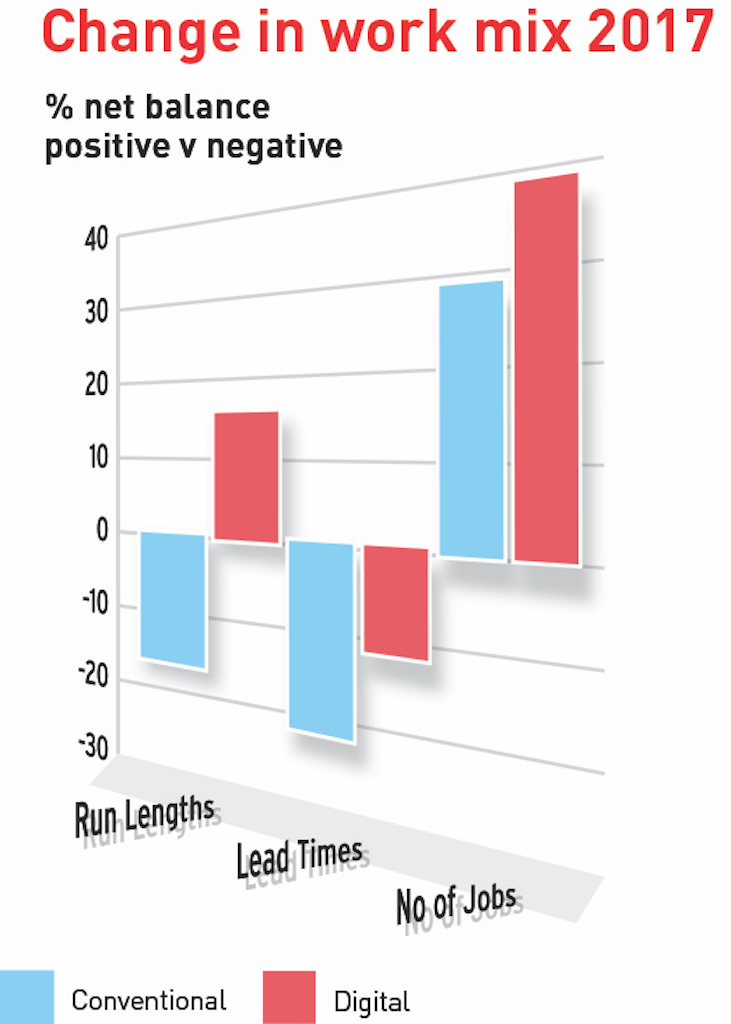

Digital print grows

The transition to digital print continues but slowly, with Functional printers now largely dependent on digital print but few packaging printers reporting significant digital sales as yet. (60% of Functional printers report more than 50% of turnover is digital, whilst just 12% of packaging printers report more than 25% of turnover is digital.) It is striking to report that only 27% of all printer participants operate a Web to Print /Storefront installation, up just 2% from 2014.

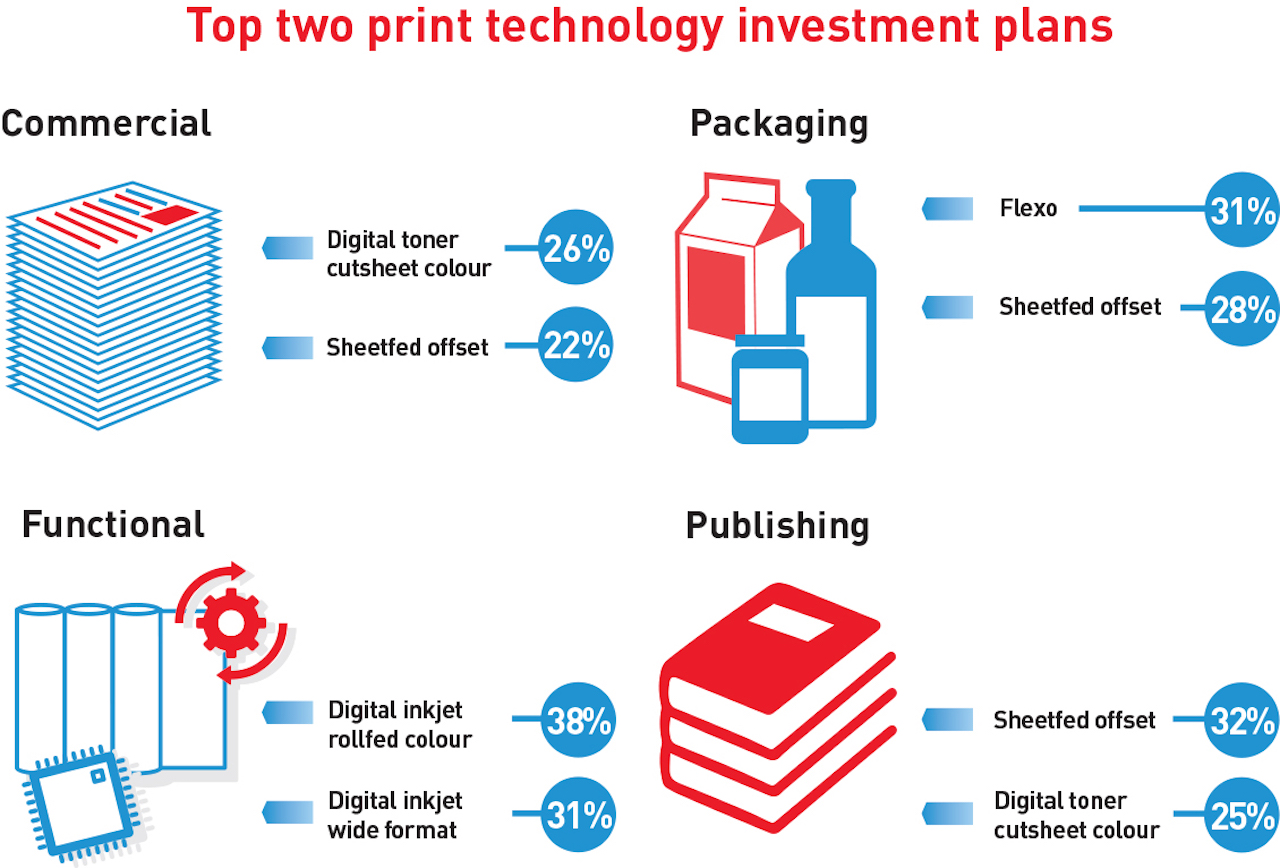

Globally printers were more willing to invest: 42 percent reported an increase in capital expenditure compared to the previous year while 9 percent reported a decline – a positive net balance of 33 percent. North America performed best with a net balance increase of 51 percent while Australia/Oceania lagged farthest behind with a net increase of only 18 percent. Not surprisingly Packaging printers reported the biggest positive net balance at +45%, Functional at +42%, Commercial at +30% and Publishing at +20%. Finishing is the most popular focus for investment for the second year running, followed by print technology and then prepress/workflow/MIS.

Plans for print investment in 2018 depend on the market sector, with Flexo the most popular choice in Packaging, followed by Sheetfed offset. In Commercial it is Digital toner cut-sheet colour that leads followed closely by Sheetfed offset and Digital inkjet wide-format. In Publishing it is Sheetfed offset that leads and Digital toner cut-sheet colour in second. While in Functional, it is Digital toner cut-sheet colour that leads and Digital inkjet wide-format in second.