The Age of Polymer Banknotes

Covid 19 accelerated and exacerbated many trends. From explosion of webinars, to online shopping and depression. The trend towards using polymer banknotes has been around for some time but it seems that now there is a stronger impetus from governments around the world and our region to launch polymer notes. Recently Saudi Arabia and Egypt put into circulation polymer banknotes. These notes all have highest security features including OVI inks and micro texts. There are many good reasons for using plastic banknote: It lasts longer and it is more difficult to forge it. They’re stronger, too: a polymer note is expected to last two-and-a-half times longer than the old paper note. The life expectancy of polymer notes also makes them more environmentally friendly. Finally, polymer notes are cleaner since their smoother surfaces are resistant to dirt and moisture. This particular feature makes it ideal banknote for using during a pandemic such as the one that we are experiencing at the moment.

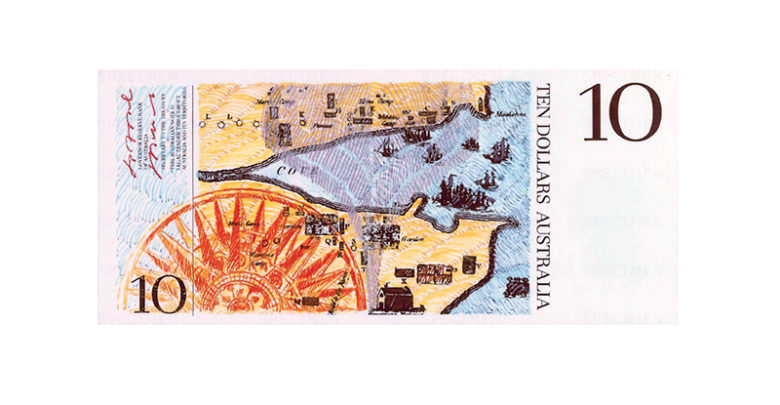

UK is printing 5-pound polymer note. However, one of the early adopters of polymer banknote is Australia. In 1985, the RBA decided to trial the new technology in a Commemorative $10 note. This note was to be the RBA’s contribution to the celebration of Australia’s Bicentenary in January 1988. In Brazil A ten Reais polymer Brazilian banknote released in April 2000 as a special edition commemorating the country’s 500th anniversary. In February 2002, Nepal issued a 10-rupee polymer banknote, commemorating the new King Gyanendra. However, few years later they stopped printing plastic money due to a number of difficulties.

Now, over 20 countries that have since switched completely to polymer banknotes include Australia, Canada, Fiji, Mauritius, New Zealand, Papua New Guinea, Romania, Vietnam, Brunei, Papua New Guinea, Romania, Cape Verde, Chile, Nicaragua, Trinidad and Tobago and the Maldives. Romania was the first European country to introduce a full set of circulating polymer banknotes.

Other countries and regions with notes printed on Guardian (Guardian is the trademark name of a polymer originally manufactured by Securency International, a joint venture between the Reserve Bank of Australia and Innovia Films Ltd. The latter completed acquisition of the former’s stake in 2013) polymer in circulation include: Bangladesh, Brazil, Chile, Costa Rica, Dominican Republic, Hong Kong (for a 2-year trial), Indonesia, Israel, Kuwait, Malaysia, Mexico, Nepal (no longer issued), Solomon Islands (no longer issued), Samoa, Singapore, Sri Lanka, Thailand and Zambia.

Strangely enough US is still avoiding polymer banknotes. You may ask why. Nobody knows exactly why. However, there are some explanations. For one thing it could be cultural. On the other hand, it has probably something to do with the amount of the physical currency issued. Unlike other currencies USD is much more popular in the countries where it is not the domestic currency. All over Eastern Europe, Asia and Africa people try to hold their savings in USD. In many cases those are kept beneath the mattress, and not on the bank accounts. So any change in US currency will have a worldwide repercussion. That is why the design of the dollar bills hardly ever change.

There are also some arguments against polymer notes. They don’t give you feeling of the real money. They look fake and you find it more difficult to count. It is slippery and It costs more to produce. There are also serious concerns about whether it is compatible with payment and vending machines. However, as technology advances these plastic bills will eventually find their way into the heart and pockets of the people.

34 Comments