Digital Production Meets the Publishing Moment

The publishing industry has seen its fair share of hurdles in recent years. Early in the pandemic, demand for print books rose sharply amid paper shortages and supply chain disruptions.

Hachette UK’s CEO, David Shelley, called this period his “most extreme” professional challenge. These challenges prompted publishers to revamp their printing and distribution strategies, benefiting print service providers with digital capabilities.

The Tides of Change: How Demand Shifts Shaped the Landscape

Nielsen BookScan data indicates a 20-30% decline in average first print runs from pre-pandemic levels, signalling ongoing pandemic impacts.

“We are still feeling the effects of the last three years,” said Kelly Gallagher, VP of content acquisition at Ingram Content Group. Even with better paper access and lower shipping costs, the production pipeline is challenged by transportation delays and inflation.

Fewer First Prints, More Reprints

Retailers now order books closer to release dates, complicating publishers’ print run size forecasts for new titles.

This shift stems from several industry changes. With more consumers buying online since the pandemic began, retailers use granular data to tweak store assortments and anticipate changing customer traffic patterns. The bullwhip effect also plays a role, as retailers must forecast demand based on limited information while considering the intricate factors enabling the right product amount to be delivered properly.

Siloed processes between retailers’ marketing and merchandising teams inhibit efficient customer data sharing as well, making it difficult to align promotional plans. This leaves publishers with a narrowed window to predict precise print run sizes for new releases.

In response to this uncertainty, publishers have taken a more conservative approach to print runs, placing smaller initial orders below their total sales forecasts. Initial print runs are determined using incomplete early demand signals, further incentivising smaller runs. By proactively limiting first print runs, publishers reduce potential unsold inventory that could lead to costly storage, shipping, and potential discounting.

Amid these dynamics, digital production, with its greater flexibility and geographic distribution, helps hedge against these risks.

The Dual Path to Modern Printing

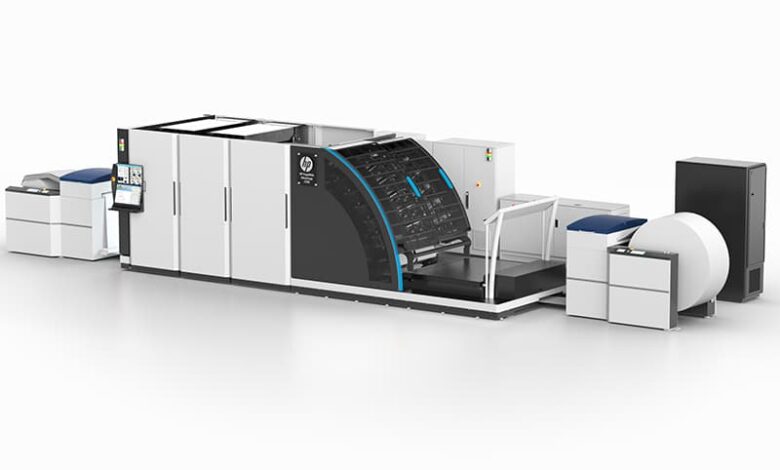

Faced with pandemic-related printer backlogs and supply chain issues, publishers increasingly turn to digital printing as an alternative to traditional offset.

Now, many utilise a hybrid model employing both methods. Per a recent survey by the American Association of Publishers, 73% aim to expand their use of print-on-demand and short-run digital printing over the next three years.

Digital inkjet presses enable rapid turnarounds on medium and large orders thanks to high-speed, high-quality capabilities. This allows print vendors to nimbly meet publishers’ needs, from rush reprint orders to offset press snags. Experts say digital flexibility is especially valuable when publishers see unexpected sales surges requiring swift action to prevent stockouts.

Leading publishers like Penguin Random House and HarperCollins are adopting digital printing for its flexibility. Digital printing also supports the creation of custom editions, such as book club or collector copies. By combining digital and offset, publishers optimise production for short runs and larger printings.

Bridging Inventory Gaps When Demand Surges

Publishers are employing “gap” printing strategies to ensure availability when unexpected demand surges for titles. This involves setting up new releases for simultaneous short-run digital backup while the main print run is ordered via offset.

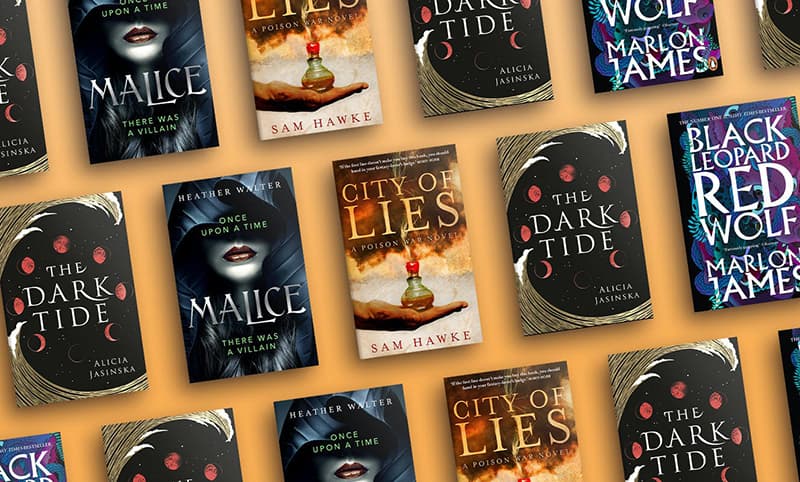

For instance, BookTok, a book-focused subcommunity within TikTok, has become an influential driver of consumer sales by helping readers discover new titles and authors. The books highlighted on BookTok often skew toward backlist titles – those published over a year ago – sometimes more than a decade old.

Backlist inventory kept by publishers is typically limited. When a BookTok mention suddenly spikes demand for an older title, the limited stock can quickly sell out, leading to missed sales opportunities during the surge of interest. Digital gap printing provides the ability to react quickly and take advantage of sales opportunities.

Gap printing also protects from supply chain disruptions delaying offset print runs. Climate events, labour strikes, and global conflicts can stall deliveries of larger offset batches. Short-run digital enables bridging potential gaps, so books stay available.

Production experts explain that rather than waiting weeks for a reprint, digital orders can get to market in days if there’s an offset delay. The hybrid approach mitigates inventory risk for publishers.

By setting up digital gap printing contingencies, publishers are gaining resilience and responsiveness.

Creating Special and Customised Editions

Additionally, creating customised and limited editions is another source of digital growth. Children’s and young adult publishers, particularly, are leveraging digital to produce specialised versions of popular titles, aiming to increase value perception and generate additional sales.

Lowering Environmental Impact Through On-Demand Printing

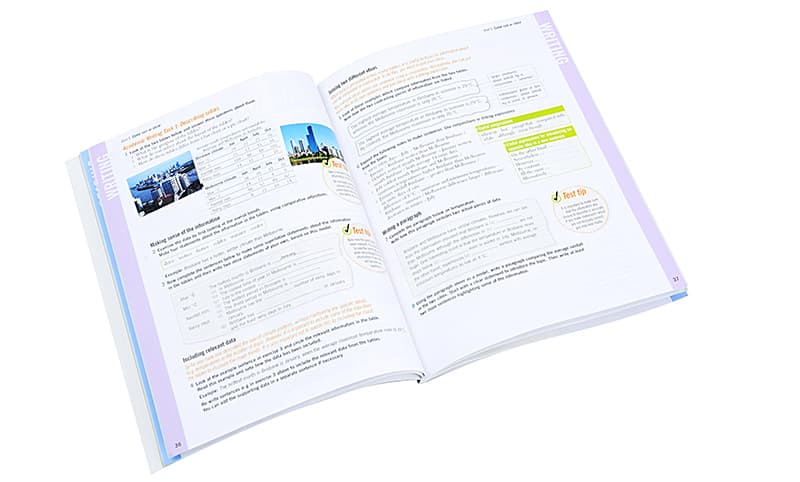

Along with driving sales, publishers leverage short-run digital printing to support sustainability initiatives. In segments like academic, scientific, and medical publishing, demand grows for eco-friendly “green” books. These utilise 100% recyclable materials and print runs precisely matching needs.

To achieve zero-inventory and localised distribution models, many publishers now produce these titles via on-demand digital inkjet printing. This allows printing only required quantities near end readers, reducing waste and overhead.

Major publishers report digital short runs reducing paper usage by up to 80% for titles with frequently updated editions. By curbing overprinting, digital on-demand enables just-in-time production of the latest editions as needed.

Looking forward, industry experts predict the continued expansion of short-run digital printing as publishers balance business needs with sustainability goals around waste and emissions reduction. On-demand production models provide the precision and flexibility to print smarter.

Ultimately, print service providers adept at short runs and quick turnarounds can find partnership opportunities to win new business and strengthen existing customer relationships.

In a landscape of uncertainty, agility and customer-focused services stand out. Companies that help publishers solve challenges and pivot their production models will emerge as leaders. Those investing in digital capabilities and capacity today will be best positioned to thrive in publishing’s new normal.

For more information, please visit: hp.com/pagewide

Ashley Gordon, Global Publishing Market Development Manager

PageWide Industrial, HP Inc