Mimaki Europe has announced that its brand-new hybrid digital textile printer, the Tx300P-1800 MkII, will headline its product line-up at FESPA 2020 (Madrid, Spain, 24-27 March, Stand 7-C20). Uniquely designed with versatility at its core, the new printer enables both direct-to-textile and transfer printing, with interchangeable platens and three different ink combinations – providing unrivaled flexibility within a single system and opening new doors for print service providers.

With Mimaki’s Tx300P-1800 digital textile printer having previously led the way for high-quality, cost-effective printing, the evolved Mimaki Tx300P-1800 MkII now adds sublimation transfer printing to its capabilities, opening up a host of possible new materials and applications. The capability to fulfill diverse applications from fashion textiles to interior fabrics and wallpaper within one system makes the printer an ideal entry-level solution.

It affords both smaller print service providers and large volume production houses all of the well-known benefits of digital print technology not attainable with analogue print methods still prevalent in the modern textile printing industry, including more cost-effective short runs and faster turnarounds, benefits that make this technology ideal for sampling.

“We are delighted to be bringing the Tx300P-1800 MkII to FESPA this year to show customers exactly how game-changing it can be for their businesses,” comments Danna Drion, Senior Marketing Manager at Mimaki EMEA. “With the introduction of this new hybrid printer, we are not only delivering an affordable, streamlined single-system solution for printing on both paper and textile, but we are also providing print service providers with the versatility to continue exploring different substrates and applications as they grow their businesses into the future. We anticipate a very bright future for digital printing in the textile industry and have no doubt that our new printer, at the cutting edge of this sector, will have a role in realising this transition.”

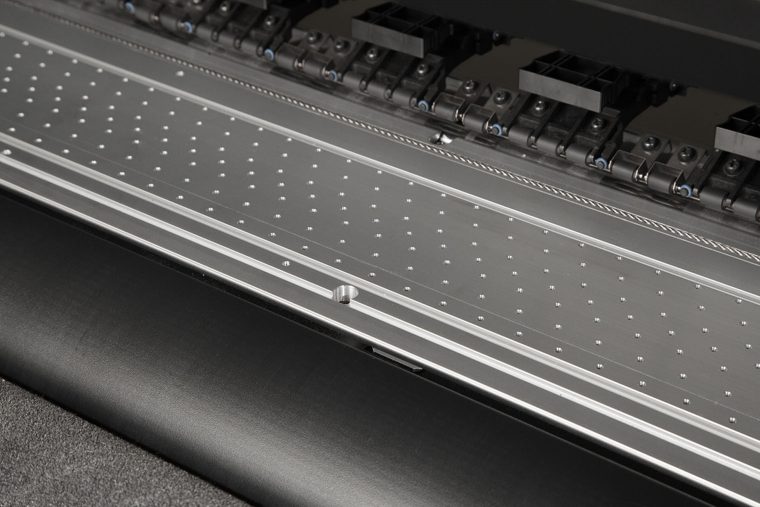

The ability of the Mimaki Tx300P-1800 MkII to switch between direct-to-textile and transfer printing is enabled by its interchangeable platens. When printing direct-to-textile, excess ink penetrated through the fabric is drained by a platen with an ink-receiving channel. When printing on heat transfer paper however, this platen can be quickly and easily exchanged for a vacuum platen needed for paper printing – without the need for service engineers.

The hybrid printer is also able to facilitate either a traditional one-way ink set, configured with any one of five ink types, as well as various combinations of inks, providing unparalleled flexibility. Users are able to select from three different ink combinations – textile pigment/direct sublimation, textile pigment/sublimation transfer, or direct sublimation/sublimation transfer – to provide the best results across various applications.

“At Mimaki, our goal is to consistently provide the best products in each market, which is why we have also worked meticulously to provide a number of clever adaptations to ensure that the print quality and reliability exceed expectations,” continues Drion. “These technologies, such as our Nozzle Check Unit to provide uninterrupted printing and minimise downtime, our MAPS4 system to reduce banding, and our new ‘high head gap’ printhead to ensure accurate ink droplet placement, are just some of the ways in which we ensure that products such as the Mimaki Tx300P-1800 MkII have the substance to continually impress our customers and provide really valuable changes to their businesses.”

The new hybrid digital textile printer will form part of an impressive exhibition line-up from Mimaki of more than 15 products at FESPA this year, including the brand-new SWJ-320EA large format solvent printer, JFX200-2513 EX large flatbed UV inkjet printer and two models of the recently launched Plus series in the large format sector alone.

Visitors can also explore Mimaki’s 3D print technology through full-colour samples created on the 3DUJ-553 3D printer, capable of faithfully replicating more than 10 million colours. Focused on providing inspiration and encouraging visitors to “experience print”, Mimaki will also be celebrating real-life customer, partner and collaborator examples and success stories, with a host of creative applications for visitors to delve into on the stand.