Xerox to Buyback $542m Shares from Carl Icahn & Associates

Xerox Holdings Corporation has agreed to repurchase all of the company’s shares of common stock beneficially owned by American businessman, investor, and philanthropist Carl C. Icahn and certain of his affiliates at a purchase price of $15.84 per share, a transaction worth approximately $542 million. Xerox expects to fund the deal with a new debt facility.

Subsequent to the closing of the transaction, Jesse Lynn and Steven Miller, employed by Icahn’s operations, and James Nelson, an independent director, will resign from the company’s board of directors. Scott Letier, who has served the board since 2018, has been appointed chairman of the board of directors, effective upon the closing of the repurchase transaction.

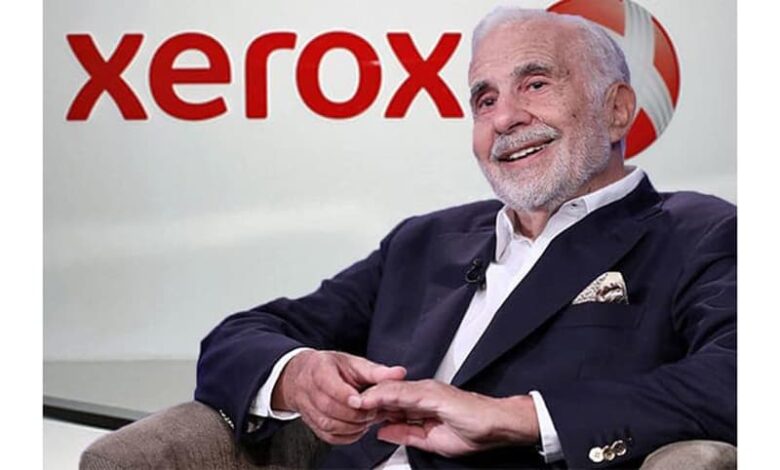

Icahn, who played a key role in scuttling Xerox’s planned merger with Fujifilm Holdings and in the company’s aborted takeover of personal computer maker HP, says, “As a longtime shareholder of Xerox, I’ve watched this iconic brand endure the hardest of times and come out stronger, all while returning substantial amounts of capital back to shareholders. I helped Xerox maintain its independence while pursuing consolidation within the print industry. I will continue to be a champion of the company and hope my activism will long be remembered as Xerox continues its positive momentum.”

Xerox CEO Steve Bandrowczack says that the company’s decision to repurchase shares is reflective of the confidence in their business, strategy, and ability to improve profitability and cash performance. “For nearly a decade, Carl and his affiliates have served as important shareholders in Xerox, providing invaluable counsel, guidance, and activism to support our evolution as a workplace technology leader. On behalf of Xerox and the board of directors, I would like to thank Carl and our departing directors for their dedication to Xerox and for contributing to our past, present, and future success.”

A special committee of the board negotiated and unanimously recommended the transaction to Xerox’s board of directors. Comprising solely of disinterested and independent directors, the special committee was advised by independent financial and legal advisors. With the exception of members employed by Icahn and his affiliates, the entire board voted in favour of the transaction.

The special committee was supported by Moelis & Company as the financial advisor, and Willkie Farr & Gallagher LLP as the legal counsel. White & Case LLP was Xerox’s legal counsel in the transaction.