Digital Textile Printing Sees a Vibrant Future

The global digital textile printing market is expected to reach $6.65 billion by 2030 at a compound annual growth rate (CAGR) of 12.1% from 2022 to 2030, according to a recent market research.

With digital printing gaining popularity worldwide due to its flexibility in printing digital images on a variety of substrates, its application in the textile industry is also witnessing a growing trend. The market’s expansion is primarily being driven by the rising demand for environmentally-friendly printing, rising demand in the apparel and advertising sectors, quicker adaptability and shorter product life cycles, the development of new technologies in the textile sector, and decreased per-unit printing costs with digital printers. In short, digital textile printing is economical, versatile, and eco-friendly, requiring minimal operational space with a capacity to manufacture high-resolution fine patterns widely utilized in various industrial segments.

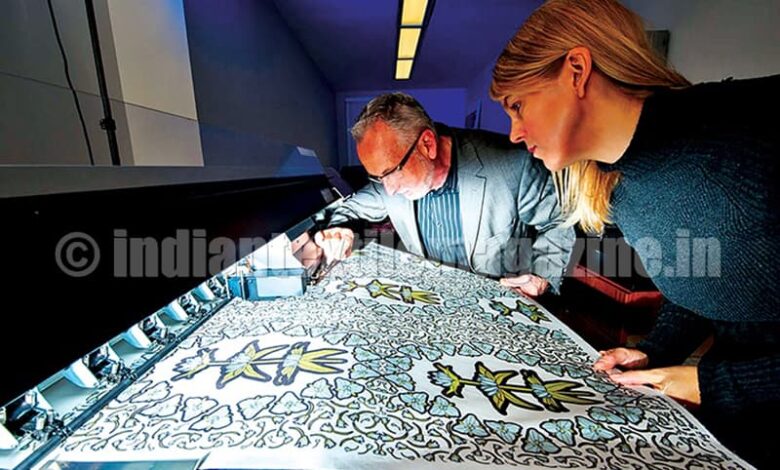

Digital textile printing is gaining traction owing to its technology that offers high-precision and high-speed printing on a range of textile materials such as cotton, polyester, nylon, silk, and other synthetic fabrics.

The increasing demand for printing textiles and fabrics across several industries is one of the major factors driving the global digital textile printing market. Today it is extensively used in advertisements, clothing, e-commerce, industrial applications, media, soft signage, and textile and décor for manufacturing a gamut of products such as bags, banners, building supplies, carpets, flags, footwear, interior décor, point-of-sale displays, posters, sportswear, upholstery, vehicle wrapping, wallpaper, and aesthetically-appealing product packaging.

Use of advanced printing applications like ultraviolet (UV) and eco solvents for operations is further catalyzing the market growth. Rising investments seen in R&D activities focused on developing three-dimensional (3D) variants are expected to further augment the market over the forecast period.

Due to advantages including non-solubility, resilience to damage, and colourfastness, sublimation inks are frequently used in the apparel, soft signage, and textile industries. The sublimation segment is expected to enjoy a market share of more than 53% by 2030, with sublimation ink to be the fastest-growing ink type during the forecast period.

While the clothing and apparel segments will continue to dominate the market, cotton was the preferred choice with a market share of 52% in 2021. As a natural textile fiber most widely used around the world, cotton’s domination is due to its excellent moisture management and extended durability. Despite cotton’s popularity, polyester is set to make inroads as the fastest-growing material in digital textile printing with a CAGR of 12.9%. Polyester has evolved into the most versatile man-made fabric and fiber due to its colourfastness, durability, and robustness as well as resistance to stretch, contraction, and abrasion. While sublimation inks are employed on polyester, reactive inks are mainly used for cotton fabric substrate due to its great wash fastness.

Due to an increase in demand for textiles in general and polyester fabrics in particular, the textile and décor and direct-to-garment sectors will continue to hold the largest share in this market over the next five years.

With the printing industry making rapid expansion due to the economic recovery post-pandemic, the digital textile printing market is anticipating a massive expansion in Europe in the near future. To address the demand for quicker turnaround times, shorter runs, and more variable data printing (VDP) with excellent quality, digital textile printing is seeing a bright future in the continent. Moreover, the thriving fashion industry has given a major boost to the development of this market in Europe. China and India, with their low labour costs, still continue to dominate in digital textile printing with the Asia-Pacific (APAC) regional market promising the fastest growth in the 2022 to 2030 forecast period.

Some of the front companies in this growing industry include Colorjet India Limited from India; Kornit Digital from Israel; Durst Group AG from Italy; Brother Industries, Konica Minolta, Mimaki Engineering, Roland DG Corporation, and Seiko Epson from Japan; d.gen, Inc. from Korea, and Dover Corporation from the USA.

As part of India’s celebration of its 75th year of independence this year, the Ministry of Culture’s campaign of Har Ghar Tiranga to be held between 13th to 15th August urging at least 200 million households to display the tricolour national flag, has set the flag-making industry scrambling to meet the ceaseless demand.

Manufacturers in the cities of Delhi, Hyderabad, Mathura, and Surat, home to some of the India’s biggest textile printing mills are forced to put in extra shifts to meet the demand. “I am printing over 17,000 flags a day now, as against 1,000 this time last year,” says a digital printer in the capital city who had to divert his firm’s resources to print the national flag and put the rest of his products such as bags, caps, and t-shirts on the back burner temporarily.