Sharjah-headquartered chemical manufacturer National Paints acquired 81% of Egypt’s state-owned Paint and Chemical Industries (PACHIN), purchasing 19.358 million company shares in a deal worth EGP 770.4 million (around $25 million).

Among the sellers were Chemical Industries Holding Company (CIHC), one of the companies of the Ministry of Public Business Sector and the largest shareholder with a stake of 44.6%, and Banque Misr, which owns an estimated stake of 10.52%, among others.

Acting as CIHC’s exclusive financial advisor in the deal was Al Ahly Pharos Investment Banking, one of the most active investment banks in Egypt. The investment bank is fully owned by Al Ahly Capital Holding (ACH), the investment arm of National Bank of Egypt (NBE), and falling under the umbrella of Al Ahly Financial Services (AFS), which delivers a broad range of financial services across investment banking.

The company is considered the first government IPO programme deal announced by Egyptian Prime Minister Mostafa Madbouly at the end of last February, which includes 32 government companies, including three banks.

Sources close to the deal have pointed out that National Paints is considering keeping PACHIN listed on the Egyptian Exchange (EGX), Egypt’s stock exchange, during the coming period.

The Emirati company beat competition from Eagle Chemicals by offering the highest price, amounting to EGP 39.8 per share.

In the deal, Al Ahly Pharos Investment Banking played the role of financial advisor to CIHC, with Shalakany Law Office, a leading corporate law firm in Egypt and the Middle East, as the company’s legal advisor.

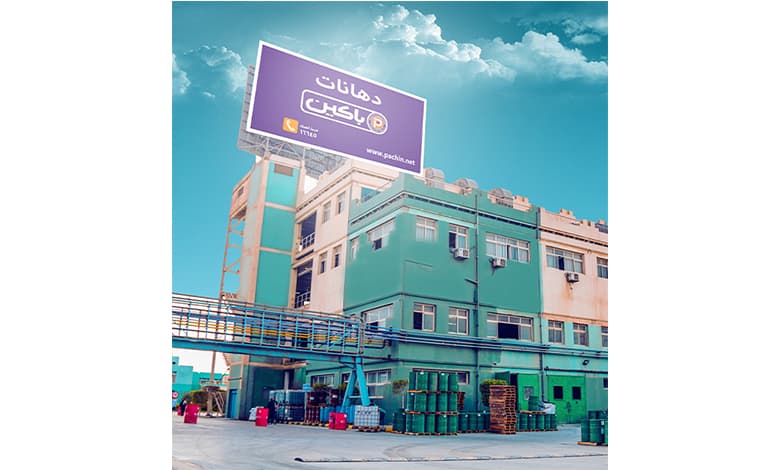

Located in El Obour City, PACHIN has over six decades of experience in the industry of paints and coatings offering a wide range of paints including decorative paints, industrial paints, wood varnishes, marine coatings, printing inks, and alkyd resins.